Electronic fiscalization is a new process implemented by taxpayers for the fiscalization of cash and cashless payments by submitting data on the sale of goods and services and fiscal invoices to the Tax Administration in real time, using a constant internet connection and fiscal service.

- The previous technology for fiscalizing invoices through tax register cash registers and fiscal printers is being abolished.

- In addition to the fiscalization of cash invoices, the fiscalization of cashless invoices is being introduced as a requirement.

- All issued invoices, both cash and cashless, are sent to the Tax Administration via the fiscal service and internet connection. Upon receipt of the invoices, the Tax Administration assigns a unique code to the invoice and sends it back as feedback to the taxpayer, which also serves as confirmation that the invoice has been fiscalized.

Who is a taxpayer for fiscalization?

- An individual who is a taxpayer for income tax and is obligated to issue invoices for the delivery of goods or services

- A legal entity that is a taxpayer for corporate income tax in accordance with the law regulating corporate income tax and is obligated to issue invoices for the delivery of goods or services

- A taxpayer who generates revenue from the sale of goods or services through self-service devices (vending machines) and is not obligated to issue invoices in accordance with the law regulating value-added tax

Who is not a taxpayer for fiscalization?

- Sale of tickets or tokens in passenger transport and luggage charges

- Sale of agricultural products at market stalls and other open spaces where outdoor sales are allowed, produced on one’s own agricultural farm

- Purchase of agricultural products by value-added tax taxpayers from agricultural producers

- Universal postal services

- Provision of banking services and insurance and reinsurance services

- Payments for participation in games of chance and recreational games

- Sale of goods on airplanes during flights of the national airline

Basic Terms

Maintenance Provider of Software Solution – A person who provides maintenance services for the software solution necessary for the operation of the fiscal service

IKOF – The identification code of the fiscalization taxpayer is an alphanumeric code generated programmatically by the fiscalization taxpayer

JIKR – The unique identification code of the invoice is an alphanumeric and graphic code generated programmatically by the Tax Administration

ENU – Electronic payment device is a hardware device that enables electronic communication with the Tax Administration

SEP – Self-service EFI portal, a web portal that the taxpayer can use to submit certain data and perform other procedures related to issuing invoices and the fiscalization process

QR Code – Quick Response Code, a type of matrix two-dimensional barcode

Business Premises – Closed or open space, movable location (delivery vehicle, vessel) used for conducting activities related to the delivery of goods and services

Fiscal Service Operator – A person who issues a fiscal invoice for cash payments or a person authorized to issue cashless invoices

Fiscal Service – The software solution used by the fiscalization taxpayer to exchange data and information about fiscal invoices with the Tax Administration

Software Solution Developer – A person who creates the software solution necessary for the operation of the fiscal service

What is required? (Technical Requirements)

- Internet – The fiscalization taxpayer must provide a constant internet connection for data exchange with the Tax Administration server.

- Equipment – The choice of equipment depends on the selected software solution, and the following is typically required:

- Computer (phone, tablet if supported by the software solution)

- A4 printer for cashless invoices (wholesale, etc.)

- Thermal printer for cash invoices (retail, hospitality, etc.)

- Digital certificate – A certificate for electronic signature issued by a certification service provider, such as Post of Montenegro or CoreIT

- Software solution – The software solution that will be used by the fiscal service to ensure the smooth issuance of fiscal invoices and prevent the avoidance of the fiscalization process of issuing invoices.

What is required? (System Requirements)

- Registration of Business Premises – 24 hours before starting to use the fiscal service for issuing fiscal invoices, each business premises must be electronically registered individually on the Self-service EFI portal.

- Registration of Operators – The taxpayer is required to register all operators on the Self-service EFI portal.

- Registration of ENU – The taxpayer must register the ENU before starting to issue and fiscalize invoices, including all ENUs that will issue and fiscalize cash invoices. ENU registration is done on the Self-service EFI portal or automatically through the software solution.

- Registration of Deposit – The taxpayer issuing invoices is required to notify the Tax Administration at the beginning of the workday, i.e., before starting operations and issuing invoices, about the cash deposit for each ENU for that workday.

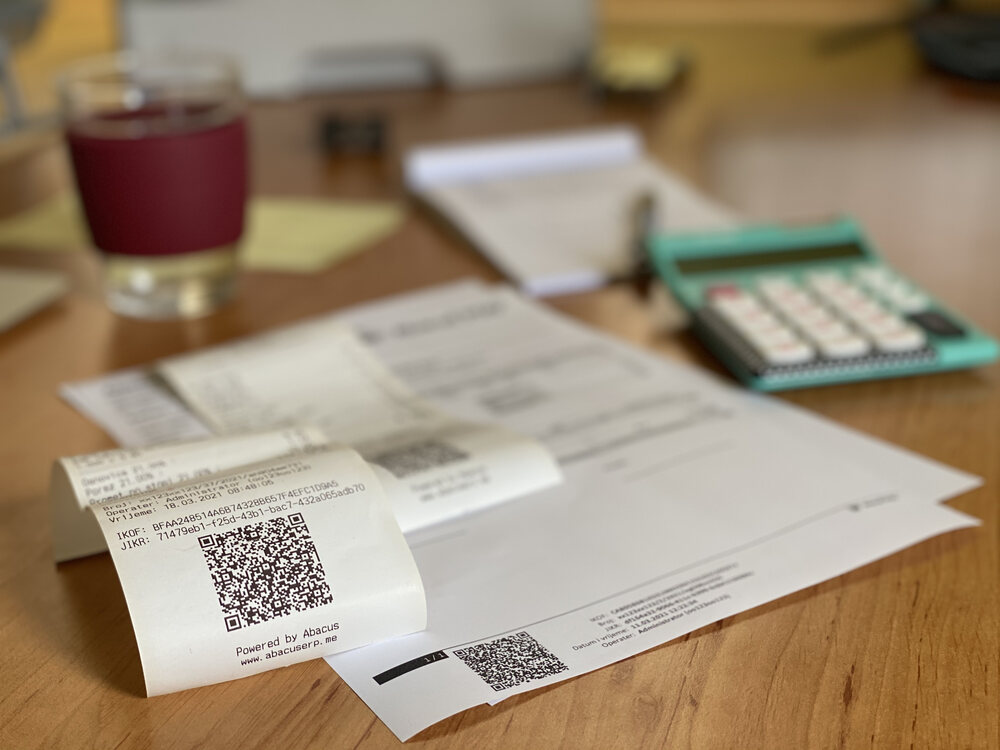

Content of a Fiscal Invoice

- Fiscal invoice number

- Time of invoice issuance (hour and minute)

- Fiscal service operator’s designation

- Identification code of the fiscalization taxpayer (IKOF)

- Unique identification code of the invoice (JIKR)

- QR code

- Payment method (cash, payment card, money transfer from a bank account, other)

- Payment deadline, in case payment is not made at the time of invoice issuance

- Tax identification number of the customer, if the transaction occurs between fiscalization taxpayers or fiscalization of cashless payments

Fiscalization Process – Phase I

- The operator enters the invoice details and items (products, prices, discounts).

- Based on the entered data, the IKOF is calculated.

- An XML message is prepared and electronically signed with a digital certificate.

- The XML message is sent to the Tax Administration server.

Fiscalization Process – Phase II

- The Tax Administration server receives the message, verifies it, and stores it.

- The Tax Administration server creates a message containing the JIKR and electronically signs it.

- The Tax Administration server sends the message to the taxpayer.

- The taxpayer receives the message and prints the invoice with the JIKR.

Creating a QR Code

- Creating a QR Code

- To ensure easy verification of a fiscalized invoice, the QR code must be printed on every issued invoice. The QR code is printed both when the invoice has been successfully reported to the Tax Administration and fiscalized (the invoice has received a JIKR), as well as in cases where the invoice cannot be fiscalized (e.g., no internet, the fiscalization service server is unavailable, etc.)

- **https://efitest.tax.gov.me/ic/#/verify?iic=DB1527B2FBF700BC9D325CB4E6208CF5&tin=12345678&crtd=2020-11-04T11:15:57 01:00&ord=12369&bu=xx123xx123&cr=fe493rm131&sw=ss123ss123&prc=528.00**

QR Code Verification

A citizen or tax inspector can scan the QR code on the invoice using the appropriate application on a smartphone or tablet, and they will be directed to the CIS page for validation to confirm the invoice’s fiscalization status.

Important to Know:

Fiscalization of Cash Invoices can be done in the following ways:

- By using the fiscal service via ENU (Electronic Payment Devices),

- Fiscalization of cash invoices at the Tax Administration or using the Tax Administration’s SEP (Self-Service EFI Portal) for taxpayers operating in areas without internet connection.

Fiscalization of Non-Cash Invoices can be done in the following ways:

- By using the fiscal service through any electronic device with the fiscalization software solution installed or by using a cloud fiscalization application,

- By using the Tax Administration’s SEP for taxpayers who are not in the VAT system and for those who operate in areas without internet access,

- Fiscalization of non-cash invoices at the Tax Administration for those taxpayers who operate in areas where establishing an internet connection is not possible and cannot access the SEP.

Fiscalization of Corrective Invoices

- A taxpayer cannot simply cancel an issued cash or non-cash invoice.

- If the customer returns goods or if something is incorrect on the issued and fiscalized invoice, the taxpayer can issue a corrective invoice referring to the original invoice that is being corrected.

- If the taxpayer issues a corrective invoice (bookkeeping debit or bookkeeping credit), only the changes (e.g., only the item being corrected) will appear on the invoice.

- If the taxpayer needs to change other incorrect elements on the invoice, they must first issue a corrective invoice with all the same elements as on the original invoice (except the date of issuance and invoice number, which relate to the corrective invoice itself), and the total amount should be negative; after that, a new invoice must be issued with the correct details, referring to the IKOF of the first issued invoice.

Fiscalization of Advance Invoices

- If a fiscal taxpayer receives an advance payment from their customer/client, such payment must be fiscalized by issuing an advance invoice.

- The advance invoice is issued for the amount of the received advance and is marked by indicating the payment type as “ADVANCE”.

- Once the goods or services are delivered based on the received and fiscalized advance, a fiscal invoice must be issued for the transaction.

- A corrective invoice is created linked to the advance invoice, where all items from the advance invoice are listed with the amounts of the advance invoice but with a negative sign (i.e., they are canceled).

- The corrective invoice should list all items that constitute the subject of the invoice (goods and services) with the full amounts and all other required details as prescribed for a fiscal invoice (as they would be listed on a normal fiscal invoice if the transaction had been completed without the advance payment).

Summary Invoice

- A summary or recap invoice is issued by the last day of the month for all invoices from that month, and in such circumstances, only the summary invoice is considered for taxation purposes. This summary invoice must contain references to the IKOF of each individual invoice for which it is issued, all of which were issued in the same month.

- When the customer pays for all services at once in a hotel at check-out, the seller will issue a summary invoice with references to each individual invoice issued during the stay, referencing the IKOF of each invoice issued to the guest during their stay.

- The same process applies to taxpayers conducting activities such as bars, cafes, restaurants, or canteens where drinks and food are consumed, and where invoices are issued at the moment of receiving the customer order. In the case of multiple orders from the same customer, a separate invoice must be issued for each order with the payment type marked as “ORDER”. If the customer will pay for all orders at once, a summary invoice will be issued at the end, referencing all issued invoices/orders.

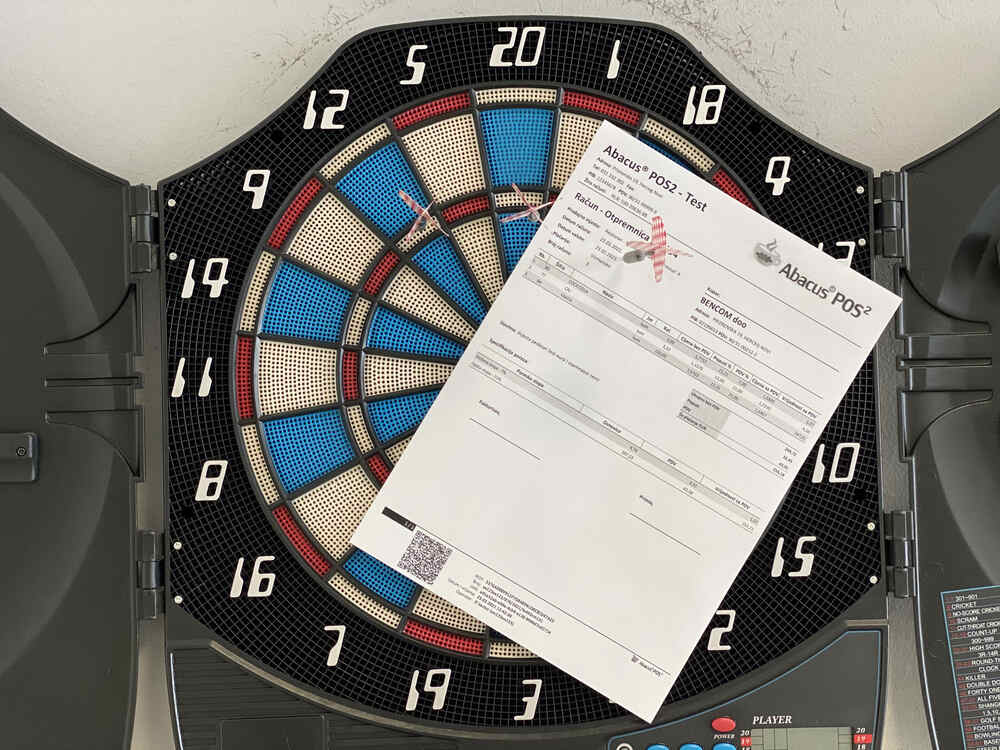

Abacus Invoicing

Our fiscalization module is extremely easy to use, with a highly intuitive user interface. Additionally, it is a very cost-effective solution as it does not require any additional expenses and can be installed on existing infrastructure.

The Abacus electronic fiscalization service is intended for all fiscalization taxpayers. Accordingly, it can be used by our clients who are already working in PIS Abacus, as well as by clients using other software solutions, or those who do not have an obligation to maintain business records but exclusively need to issue fiscalized invoices.

PIS Abacus has not been changed for fiscalization purposes; instead, an additional service has been developed that communicates with the Tax Administration and allows invoices to be fiscally processed in the most efficient way. All issued invoices, both cash and non-cash, are sent to the Tax Administration via the fiscal service and internet connection. Upon receipt of the invoice, the Tax Administration assigns a unique code and sends it back as a confirmation to the taxpayer, which serves as proof that the invoice has been fiscally processed.

The advantage for our clients is the integration of this solution within PIS Abacus, which provides existing users with simplicity and security in their operations. An additional advantage of this service is its compatibility with other software. This enables our clients who do not use PIS Abacus to successfully use the new service. Specifically, clients who use software from companies headquartered outside of Montenegro, which quickly and efficiently developed an additional module aligned with our fiscalization module, thereby facilitating the implementation of the new law. These clients, using our installation instructions, have independently implemented the solution, effectively enabling fiscalization. In practice, since January, we have had several cases of successful implementation involving large legal entities in Montenegro.

In addition to the mentioned possibilities, a web portal has been developed for clients who do not use specific software but wish to independently create and issue fiscalized invoices. The portal is multilingual and very easy to use. The user enters data about services and partners, which can later be selected when creating a fiscalized invoice. Access to this portal is available from any type of electronic device.

Username: demo

Password: demo